Realtors may post mixed Q4 results as residential demand moderates

Mumbai, 11 April

India’s top listed real estate developers may report a mixed quarterly performance in terms of sales and

revenues in the fourth quarter of 2024-25 (Q4FY25) because some of

them missed their pre-sales guidance due to launch delays and moderate residential demand across major cities.

“Pre-sales and price growth seen in the past three years have strong embedded profits. Assuch, accounting profits are likely toimprove onayear-on-year (Y0-Y) basis. But collections and operating cash flows are likely to remain tepid at 0-5 per cent due to slower sales velocity while fixed costs and business development commitments remain elevated,” said Mahaveer Jain, director, India Ratings & Research.

The January-March period is typically considered a strong quarter for real estate. Until FY24, buyers were incentivised to accelerate home purchases in March to claim

RESULT PREVIEW

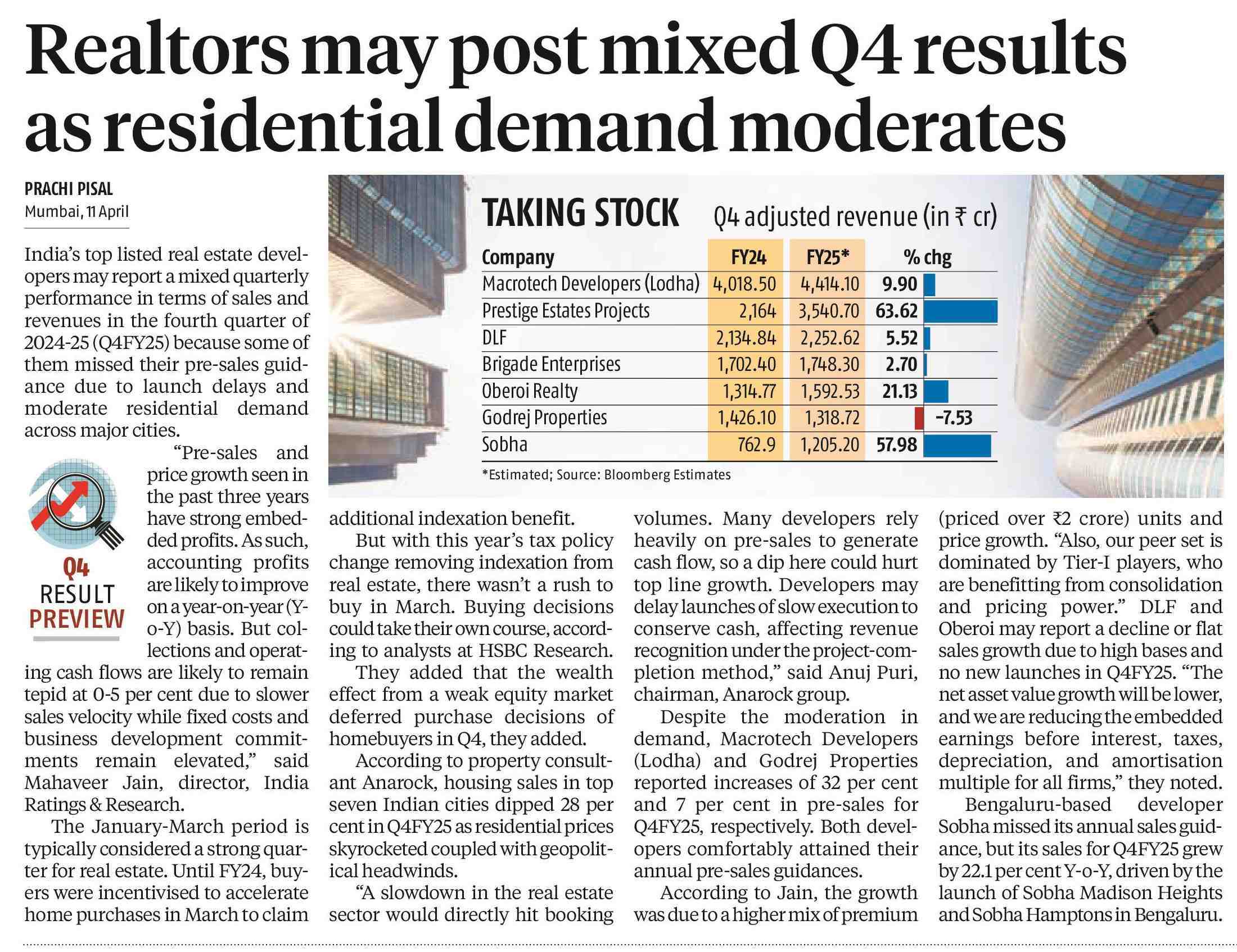

asresidential demand moderates N ‘TAK|NG STOCK o adjusted revenue (in₹ cr) N

. (ompany FY24 FY25* % chg Macrotech Developers (Lodha) 4,018.50 4,410 9.90 J§ Prestige Estates Projects 2,64 3,540.70 63.62 | DLF 2,34.84 2,252.62 552 Brigade Enterprises 1,702.40 1,748.30 2.70 | Oberoi Realty 130677 1,592.53 21.13 . A Godrej Properties 1,42610 1,318.72 l -1.53 il Sobha 1629 120520 57.98 o wari O II

additional indexation benefit.

But with this year’s tax policy change removing indexation from real estate, there wasn’t a rush to buy in March. Buying decisions could take their own course, according to analysts at HSBC Research.

They added that the wealth effect from a weak equity market deferred purchase decisions of homebuyers in Q4, they added.

According to property consultant Anarock, housing sales in top seven Indian cities dipped 28 per centin Q4FY25 as residential prices skyrocketed coupled with geopolitical headwinds.

“A slowdown in the real estate sector would directly hit booking

*Estimated; Source: Bloomberg Estimates

volumes. Many developers rely heavily on pre-sales to generate cash flow, so a dip here could hurt top line growth. Developers may delay launches of slow execution to conserve cash, affecting revenue recognition under the project-completion method,” said Anuj Puri, chairman, Anarock group. Despite the moderation in demand, Macrotech Developers (Lodha) and Godrej Properties reported increases of 32 per cent and 7 per cent in pre-sales for Q4FY25, respectively. Both developers comfortably attained their annual pre-sales guidances. According to Jain, the growth was due to ahigher mix of premium

(priced over %2 crore) units and price growth. “Also, our peer set is dominated by Tier-1 players, who are benefitting from consolidation and pricing power.” DLF and Oberoi may report a decline or flat sales growth due to high bases and no new launches in Q4FY25. “The net asset value growth will be lower, and we are reducing the embedded earnings before interest, taxes, depreciation, and amortisation multiple for all firms,” they noted.

Bengaluru-based developer Sobha missed its annual sales guidance, but its sales for Q4FY25 grew by 22.1 per cent Y-0-Y, driven by the launch of Sobha Madison Heights and Sobha Hamptonsin Bengaluru.