Realty rally hits a wall - cracks only widening

The Nifty Realty has been among the weakest sectoral performers, with the real estate index falling 22%. Housing sales have dropped 9% in Q3, and the sector's outlook is uncertain. Despite an overall drop, total sales value rose 14%, driven by luxury housing demand. Property market is constrained by supply.

Realty rally hits a wall - cracks only widening

Soft volumes and high prices expose weak beams beneath market's fragile rebound

RAM PRASAD SAHU

Mumbai, 28 September

The Nifty Realty has been one of

the weakest sectoral performers

over the past year. While the

benchmark Nifty 50 slipped 6 per

cent, the real estate index fell 22

per cent during the same period.

Godrej Properties led the decline,

losing 40 per cent of its value,

followed by Brigade Enterprises,

which was down 33 per cent.

Unless the festival season

brings a surprise lift, the slump is

likely to persist. Third-quarter (Q3)

housing sales volumes have

dropped 9 per cent, prices have

climbed sharply, affordability has

eroded, and the job market

remains weak.

The sector's outlook hinges on

housing sales — and the latest

numbers don't inspire confidence.

Estimated sales volumes across

the top seven cities fell 9 per cent

year-on-year to 97,000 units in Q3

2025, from 107,000 units a year

earlier. Despite the drop, total sales

value rose 14 per cent, pointing

to demand for luxury and super-

luxury housing. Average residen-

tial prices in these cities grew 9 per

cent over the same period.

"While affordability remains

stretched in most cities, price

growth has cooled from the

double-digit pace of the past few

years," said Anuj Puri, chairman

of Anarock Group.

Motilal Oswal said developers'

operating performance in the first

quarter (Q1) of 2025-26 (FY26) fell

short of expectations due to

delayed project launches affecting

presales. The brokerage has kept

its FY26 presales forecasts intact

but will track launches and

deliveries closely. Prestige Estates

Projects and Lodha Developers

(formerly Macrotech Developers)

remain among its preferred bets.

Even with slower overall

volumes, presales for listed

developers have held up well. They

rose 19 per cent in 2024-25 and

39 per cent in Q1FY26. Lodha has

guided for 20 per cent growth in

FY26 presales, Godrej expects 10

per cent, and Prestige is aiming for

47 per cent, helped by spillover

demand from the previous year.

The property market has

shown resilience, and large

branded players are constrained

more by supply than demand, said

Nomura. It views the correction in

real estate stocks - driven by sea-

sonal weakness, economic uncer-

tainty, and job-loss headlines - as

a buying opportunity. Stocks such

as Lodha, Oberoi Realty, and

Aditya Birla Real Estate offer

long-term value, it added.

Nuvama analysts argue that

stock performance will depend on

how the housing cycle broadens,

the product mix, and interest rate

cuts. They don't expect a quick fix

for weak volume growth, given

shrinking affordability and the

limited supply of mid-income

housing. They expect volatility to

persist, with mortgage rate cuts

cushioning the downside but

valuation and volume concerns

capping the upside.

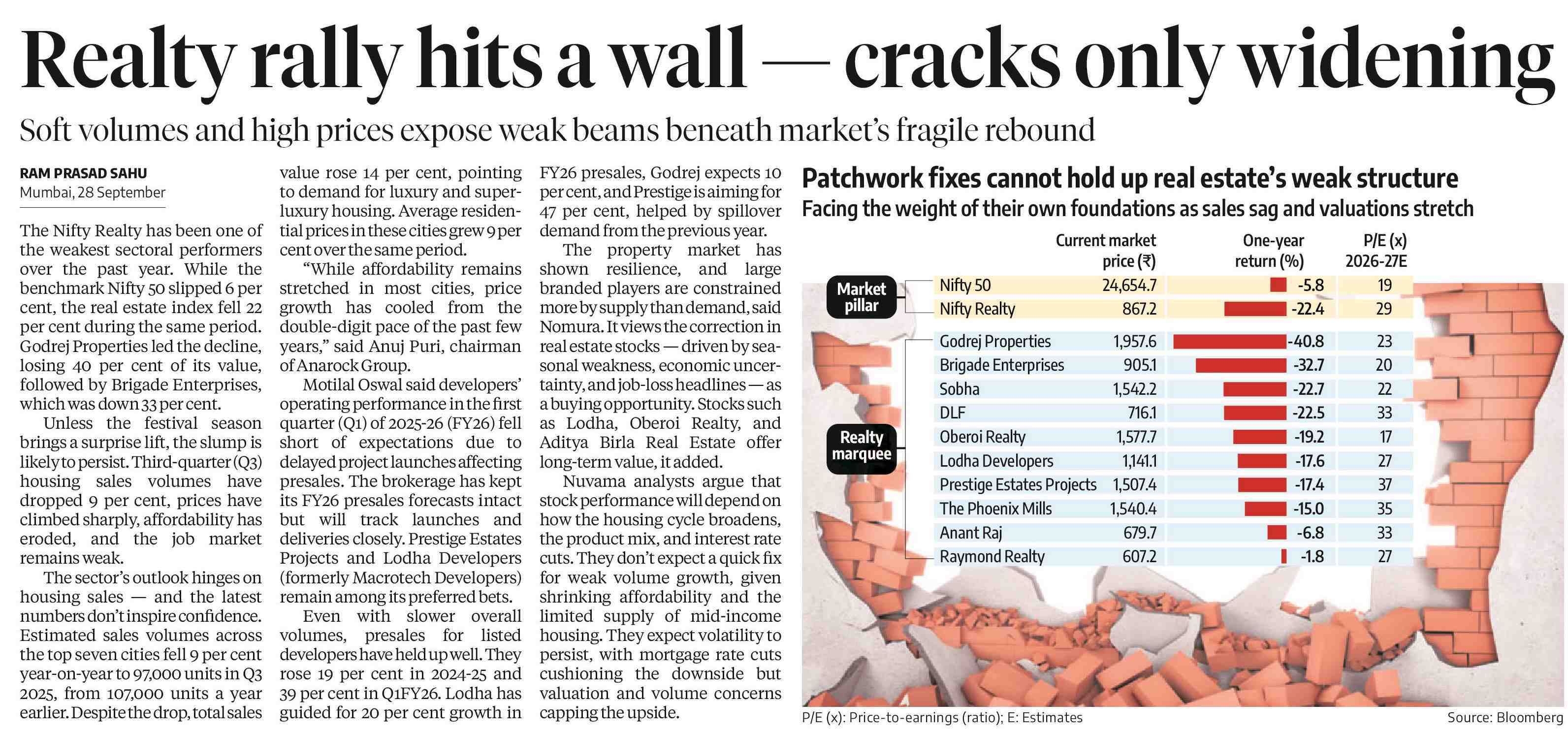

Patchwork fixes cannot hold up real estate's weak structure

Facing the weight of their own foundations as sales sag and valuations stretch

| | Current market price (₹) | One-year return (%) | P/E (X) 2026-27E |

|----------------|--------------------------|--------------------|---------------|

| Market pillar | Nifty 50 | 24,654.7 | -5.8 | 19 |

| | Nifty Realty | 867.2 | -22.4 | 29 |

| | Godrej Properties | 1,957.6 | -40.8 | 23 |

| | Brigade Enterprises | 905.1 | -32.7 | 20 |

| | Sobha | 1,542.2 | -22.7 | 22 |

| | DLF | 716.1 | -22.5 | 33 |

| Realty marquee | Oberoi Realty | 1,577.7 | -19.2 | 17 |

| | Lodha Developers | 1,141.1 | -17.6 | 27 |

| | Prestige Estates Projects | 1,507.4 | -17.4 | 37 |

| | The Phoenix Mills | 1,540.4 | -15.0 | 35 |

| | Anant Raj | 679.7 | -6.8 | 33 |

| | Raymond Realty | 607.2 | -1.8 | 27 |